BMO Personal Banking

What can we help you find today?

Special offers

From everyday banking to credit cards, find ways to save money and make real financial progress.

Financial resources

Access our financial resource hub to help you manage your money and plan for your future.

BMO online support

The fastest way for you to get support. Start by answering a few questions.

Let's talk spending in relationships

Couples are more likely to argue about spending habits. Explore how couples communicate when it comes to finances.

Security alerts: Learn what to look for

Identify and learn how you can protect yourself against the different types of fraud.

Thank you for ranking us #1

Award-Winning Customer Satisfaction among the Big 5 Retail Banks.

Explore bank accounts

Whatever your financial goals are, we’ve got a bank account to help you get there.

A chequing or savings account?

Learn the difference between the two and how you can use both to your advantage.

How to switch banks in 6 steps

Considering a new bank? Learn how to make a quick and easy switch.

Credit cards explained in 15 minutes

Here's what you need to know to apply, make payments and use your credit card.

Need help choosing a credit card?

Answer a few easy questions and we'll recommend the best cards for you.

A card that reflects your True Name™

With True Name™ by Mastercard®, proudly display the name you most identify with.

Fill up on savings

Get up to seven cents off per litre on Shell® fuel, only for BMO cardholders98

Lock in BMO's 130-day mortgage rate guarantee – the longest of any major Canadian bank footnote dagger dagger

Explore mortgages

Whether you’re looking for your first home, buying a second, or refinancing, we can help.

How increasing mortgage rates may affect you

Learn how rising interest rates may impact your mortgage.

Become mortgage-free faster

Find out how you can pay your mortgage faster with accelerated payment options.

Homeowner ReadiLine®

This unique lending option is a combination of a mortgage with the flexibility of a line of credit.

Investment learning centre

Articles, videos and tools to provide you with expert guidance on your investment journey.

Not sure which investment is right for you?

Tell us a bit about yourself and get started on your investment journey.

BMO Smarter Investing Podcast

Tune in to the latest market developments and insights from our experts.

Financial resources

Access our financial resource hub to help you manage your money and plan for your future.

Podcast: Has the Economy Already Landed?

A snapshot of the impact that the labour market, food prices and energy costs are having on inflation across North America.

How to improve your credit score

You'll also learn about how it impacts your application for a credit card, loan, or mortgage.

What is mortgage amortization?

Discover how mortgage amortization works and calculate your mortgage payments over a time span.

Investing during a market decline

Learn how to navigate a downturn and protect your investments.

BMO SmartProgress™

Explore resources and tools that will help strengthen your financial literacy skills.

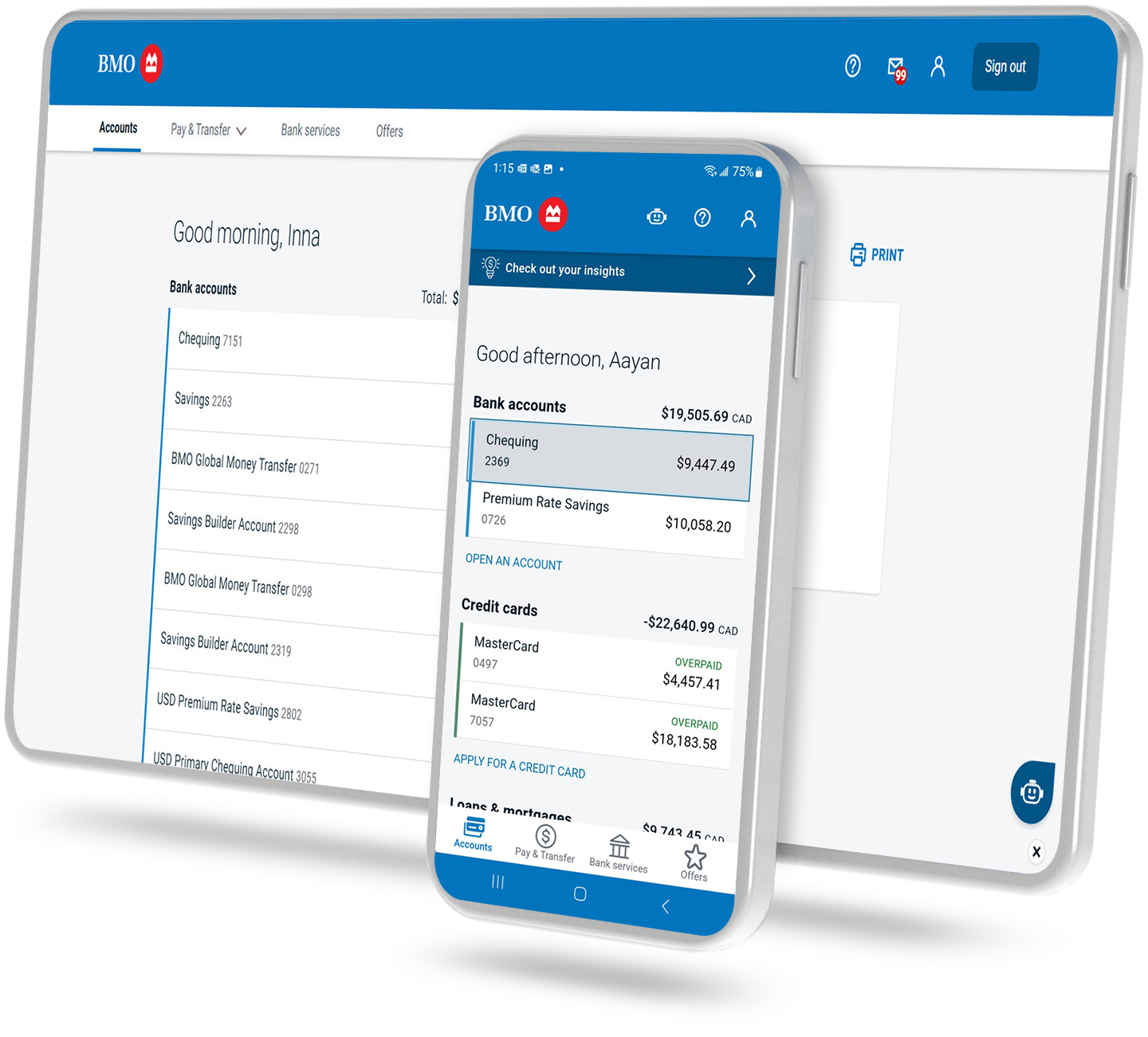

Get our award-winning mobile banking app

Our app rankednumber onein Canada for digital money management. Enjoytwenty plusfeatures – from spending insights to global transfers.

Not sure where to begin? We’ll help you choose

Credit cards

From cash back to AIR MILES to rewards, we’ll help you choose the best credit card for you.